News & Events

News & Events

Andrew Spink QC will join a panel discussion on recent developments and future trends in the regulation of cryptoassets. The webinar will be held on Thursday 7th October from 5.45pm to 7pm and is open to all FSLA members.The panel event will chaired by Charlotte Hill, head of Taylor Wessing’s UK Financial Services Regulatory group and will feature the following speakers: Andrew Spink QC, Outer Temple ChambersKatie Fry-Paul, Associate at Taylor Wessing LLPRichard Fox, Head of Markets Policy at the Financial Conduct AuthorityJannah Patchay, Director and Founder of Markets Evolution. The 1 hour webinar will focus on the latest developments, future trends and areas of concern in the fast evolving and increasingly important field of crypto-regulation. The webinar will be of interest…

Events 7 Oct, 2021

Watch a recent webinar by the pensions team and business crime team at Outer Temple Chambers, discussing a business crime lawyer’s perspective on the Pension Schemes Act 2021. Outer Temple Chambers hosted a well received talk on 16th July 2021, focusing on criminal proceedings arising out of the Pension Schemes Act 2021. Two of our finest pensions barristers, Andrew Spink QC and David E. Grant, joined two of our renowned business crime barristers, Michael Bowes QC and Oliver Powell, to examine how and when a regulatory matter may become a criminal matter and, if it looks like it might do so, how to respond, prepare and advise your clients. The Topics Andrew Spink QC: Welcome and introductionDavid E Grant: Civil…

Webinars & Recordings 28 Jul, 2021

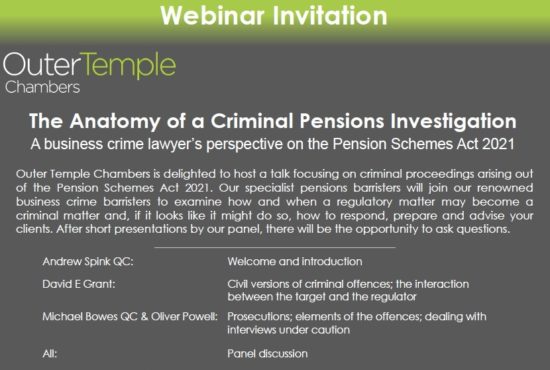

You are invited to join Outer Temple Chambers to discuss a business crime lawyer’s perspective on the Pension Schemes Act 2021. Outer Temple Chambers is delighted to host a talk focusing on criminal proceedings arising out of the Pension Schemes Act 2021. Our specialist pensions barristers will join our renowned business crime barristers to examine how and when a regulatory matter may become a criminal matter and, if it looks like it might do so, how to respond, prepare and advise your clients. After short presentations by our panel, there will be the opportunity to ask questions. Agenda Andrew Spink QC: Welcome and introductionDavid E Grant: Civil versions of criminal offences; the interaction between the target and the regulatorMichael Bowes…

Events 6 Jul, 2021

Following the release of The Legal 500 EMEA 2021 results, Outer Temple is proud to announce that several of our members have been ranked in the Middle East Guide for commercial law. Outer Temple has also been recognised as a Recommended Set of Chambers for commercial law. These rankings reflect our competency in providing expert advisory and advocacy services and facilities for our contract and commercial, financial, regulatory, taxation and trusts, employment and arbitration work in the UAE and across the Middle East. As the first and only set of barristers’ chambers to registered office within the Dubai International Financial Centre (Part 1), members have had a busy year working with DIFCA and the Dubai Financial Services Authority. The Legal…

News 16 Apr, 2021

Andrew Spink QC of Outer Temple Chambers and Hin Liu of Oxford University were recently invited to join the Tech Dispute Network’s “Need to Know Basis” podcast for an episode on the topical question of the legal basis on which cryptoassets are held on behalf of investors by intermediaries, such as exchanges. It seems like everyone is a cryptoasset investor these days. The surging value of Bitcoin, increased legitimacy leant to the sector by the recommendations from established institutions, and the long hours the world has spent in front of its laptop without alternative distraction has created a booming market for digital assets, which has expanded beyond cryptocurrencies such as Bitcoin and led to mainstream adoption of formally niche products like…

News 1 Apr, 2021

Andrew Spink QC and Helen Pugh signpost the potential impacts of the Pensions Scheme Act 2021 on restructurings. The Pension Schemes Act 2021 (‘the Act’) addresses a number of critical areas concerning pensions, and importantly brings about a number of significant changes. The focus of this briefing note is upon 4 key areas relevant to restructurings: The creation of two new criminal offences with penalties of up to 7 years’ imprisonment and an unlimited fine; Mirror civil liability with penalties of up to £1m; The expansion of the existing contribution notice/ moral hazard powers of the Pensions Regulator (‘TPR’); The expansion of notification requirements for certain corporate activity. Whilst the Act received Royal Assent on 11 February 2021, it is…

Legal Blogs 10 Mar, 2021

The Pension Schemes Act 2021 came into force on 11 February 2021 and is set to make fundamental changes to the UK pensions landscape. Andrew Spink QC and Oliver Powell signpost the key changes that have been introduced by the Act, focusing on the new powers that will be available to The Pensions Regulator and the three new criminal offences created by the Act. The Pension Schemes Act 2021 addresses a number of critical areas concerning pensions, and importantly brings about a number of significant changes. Broadly distilled, the Act: establishes a new framework for the formation and administration of collective money purchase pension schemes; creates three new criminal offences; introduces a new power to impose civil penalties of up to £1m; expands…

Legal Blogs 3 Mar, 2021

Following on from their previous article considering the scope of the moratorium from a lender’s perspective, Andrew Spink QC, Justina Stewart and Saaman Pourghadiri consider the thorny question of whether all defined benefit pension scheme contributions are exempt from the payment holiday under the moratorium. In this note Andrew Spink QC, Justina Stewart and Saaman Pourghadiri consider one important issue for insolvency and pensions practitioners which arises from the Moratorium in Part A1 of the Insolvency Act 1986 (“IA 86”) introduced by the Corporate Insolvency and Governance Act 2020 (“CIGA 2020”). The note sets out various arguments going to the vexed issue of which forms of employer contribution to an occupational pension scheme fall within the payment holiday under the…

Legal Blogs 15 Oct, 2020

With suspension of insolvency enforcement due to end shortly, lenders face the prospect of borrowers entering the new, free-standing moratorium. Andrew Spink QC, Justina Stewart and Saaman Pourghadiri consider the impact of the new moratorium from a lender’s perspective. How vulnerable are lenders upon entry into the moratorium? Which categories of charge holders are more vulnerable? How might lenders protect their positions, and what opportunities might a moratorium present to lenders? In this in-depth article, Andrew, Justina and Saaman consider: Protections for lenders arising from: the requirement of companies to meet lenders’ capital and interest payments during the moratorium; the disapplication of “ipso facto” provisions to most financial services contracts; and the ability of lenders, in practice, to stymy the…

Legal Blogs 9 Sep, 2020

Watch Saaman Pourghadiri question Andrew Spink QC on the topic of enforcing foreign judgments and the case of GFH Capital Ltd v Haigh. Welcome to the first in the series of of ‘Ask a Silk’. These videos are short and digestible vlogs, normally in the form of a Q&A between a silk and junior in chambers about a recent case, piece of legislation or other topical areas of commercial law. Enforcement of Foreign Judgments This vlog features one of our finest silks, Andrew Spink QC, and junior, Saaman Pourghadiri. They discuss the first judgment of an English court enforcing a judgment of the Dubai International Financial Centre: GFH Capital Ltd v Haigh [2020] EWHC 1269 (Comm). Watch the vlog here …

Webinars & Recordings 12 Jun, 2020

Andrew Spink QC and Saaman Pourghadiri summarise how contractual obligations may be affected by the Covid-19 pandemic and measures taken to quell it. Governments across the world have taken unprecedented steps to restrict ordinary daily life in an effort to mitigate the severe impact of Covid-19. The human impact is enormous but the pandemic will also have profound short and long-term economic effects. Andrew and Saaman of summarise how contractual obligations may be affected by the pandemic and the measures taken to quell it. This note will look at some key elements in construing Force Majeure (“FM”) clauses, Article 82 of the DIFC Contract Law 2004 (“Article 82”), and common law frustration before considering MAC clauses Read the full guidance…

Covid-19 1 Apr, 2020

Andrew Spink QC and Saaman Pourghadiri summarise how contractual obligations may be affected by the Covid-19 pandemic and measures taken to quell it. Governments across the world have taken unprecedented steps to restrict ordinary daily life in an effort to mitigate the severe impact of Covid-19. The human impact of Covid-19 is enormous but the pandemic will also have profound short and long-term economic effects. In response to various enquiries over the last few days, Andrew and Saaman have constructed a guidance note looking at some key elements in construing Force Majeure (FM) clauses and the common law doctrine of frustration before considering Material Adverse Change (MAC) clauses. Whether Covid-19 and the global response to it fall within FM or MAC…

Covid-19 30 Mar, 2020